Total Assets in OPay: How to Track, Maximize, and Avoid Surprises with USSD or App

Views: 0

If you’ve ever used OPay and gotten confused by the term “Total Assets,” you’re not alone. Unlike traditional banks where you can just hit “Check Balance,” OPay takes a more detailed approach—and for good reason.

In this guide, we’ll break down what total assets in OPay actually means, how to check opay using the *955# USSD code or the app, and answer related questions like “Total assets in OPay limit”, “What is the market cap of OPay?”, “How much is OPay worth?”, and “Which bank owns OPay?”

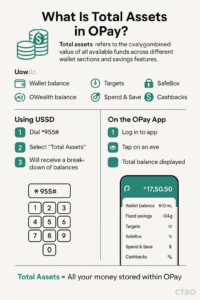

What Does “Total Assets” Mean in OPay?

Let’s simplify this: Total assets in OPay is the combined value of all the funds you have across different pockets inside your OPay account. It’s not just what’s sitting in your wallet. It includes:

- Wallet balance

- OWealth (investment savings)

- Fixed Savings

- Targets (goal-based savings)

- SafeBox (locked savings)

- Spend & Save (auto-savings from spending)

- Cashback rewards

So when you tap “Total Assets,” you’re seeing the full picture of your OPay money—not just your spendable balance.

How to Check Total Assets Using USSD

To check opay balance If you don’t have data or you’re using a feature phone, no worries. Just dial:

*955# > Select “Total Assets”

Once selected, OPay will send you a breakdown of all your balances via SMS or show it on-screen depending on your phone type.

How to Check Total Assets on the OPay App

If you’re on the app, it’s even simpler:

- Log in to your OPay app.

- Tap the little eye icon on your balance dashboard.

- You’ll see the total value of everything you own in OPay.

This includes even tiny cashback rewards you may have forgotten about. It’s all summed up right there.

Why Is It Called “Total Assets”?

OPay uses “total assets” because their system is more modular than traditional banks. Instead of dumping everything into one balance, OPay spreads your money across various tools that help you save, earn, or invest. The total assets metric wraps all those tools into one figure.

Think of it like your financial dashboard. One number = all your money in OPay.

Total Assets in OPay Limit: Is There One?

Yes, there’s a limit.

Just like any digital wallet or mobile money account, OPay sets limits based on your account tier. These limits affect how much you can have in your wallet and sometimes how much you can save in tools like OWealth or SafeBox.

Here’s the typical breakdown:

- Tier 1 (basic account): ₦300,000 total asset limit

- Tier 2 (BVN verified): ₦500,000 – ₦1,000,000

- Tier 3 (fully verified): ₦5,000,000 and up

If you’re hitting your total assets in OPay limit, consider upgrading your KYC level in the app by submitting more ID documents.

What is the Market Cap of OPay?

As of the latest reports, OPay is privately held, so it doesn’t have a “market cap” in the traditional stock exchange sense. But here’s what we know:

- Latest valuation: $2 billion+

- Major investors: SoftBank, Sequoia Capital China, GGV Capital

- Status: One of Africa’s most valuable fintech startups

So if you’re googling “What is the market cap of OPay?”, just know that while it’s not publicly traded, the company’s valuation gives you an idea of its market footprint.

How Much is OPay Worth?

As of its last funding round in 2021, OPay was valued at over $2 billion. Since then, the company has expanded its services and customer base across Nigeria and started exploring other African markets.

In 2025, experts estimate OPay could be worth between $2.5 billion and $3 billion, thanks to its growth in mobile payments, agent banking, and digital savings tools.

Which Bank Owns OPay?

No bank owns OPay.

OPay is an independent fintech company, not owned by any commercial bank. However, it is licensed by the Central Bank of Nigeria (CBN) as a mobile money operator and works with Nigerian banks for settlement and payment infrastructure.

So if you’re asking “Which bank owns OPay?”—the answer is none. But it does partner with several banks to provide its services.

Bonus: What Can You Do With Total Assets in OPay?

Once you know your total assets, you can:

- Track your financial growth

- Set savings targets

- Invest in OWealth for better returns

- Withdraw from SafeBox or Fixed Savings when matured

- Use cashback for airtime or bill payments

- Auto-save using Spend & Save

And since you can access this info via USSD or the app, you always have a full picture of your financial position.

Final Thoughts

Understanding total assets in OPay helps you unlock the full potential of the app. Whether you’re investing with OWealth, saving in SafeBox, or simply tracking cashback, knowing where your money is gives you better control.

From total assets in OPay limit to how much OPay is worth and which bank owns it, you now have the full picture.

Related post

Opay USSD Code: The Complete List